Bangladeshi Payment Methods for Online Transactions

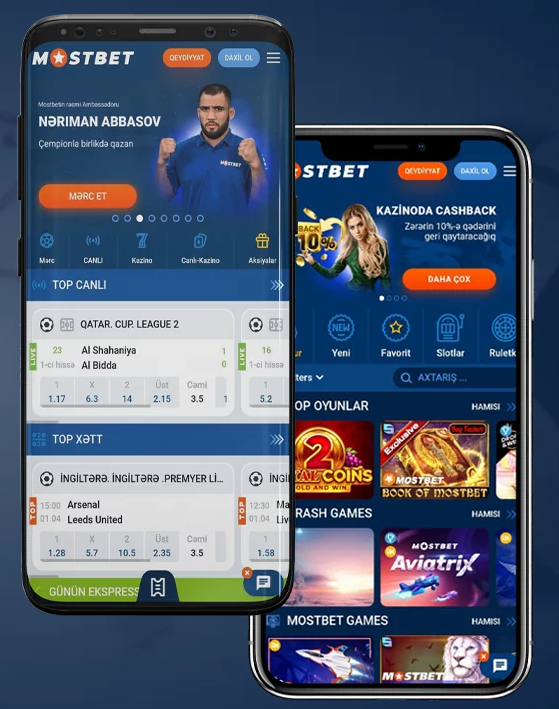

Bangladesh has witnessed significant growth in digital payment methods in recent years, enabling easier access to online services across the country. From ecommerce sites to digital gaming, users now have various options at their disposal for making transactions effectively. In this regard, one of the popular applications that have emerged is the Bangladeshi Payment Methods for Online Casino Transactions Mostbet app, which has simplified payment methods for online gaming enthusiasts and bettors. In this article, we will explore the range of payment methods that are prevalent in Bangladesh, how they work, and their advantages and disadvantages.

1. Mobile Payment Solutions

Mobile payment solutions have revolutionized the way people in Bangladesh carry out transactions. Services like bKash, Rocket, and Nagad enable users to send and receive money using their mobile phones. These platforms allow customers to make payments for goods and services, pay utility bills, and even transfer money to friends and family with ease.

1.1 bKash

bKash is one of the leading mobile financial services in Bangladesh. Launched in 2011, it became popular quickly due to its user-friendly interface and extensive agent network throughout the country. Users can create an account through their mobile number, and once registered, they can top up their balance, send money, and pay for various services. The platform has also expanded its services to allow online merchants to accept payments through bKash, making it a versatile option for ecommerce.

1.2 Rocket

Another popular mobile payment method is Rocket, which is operated by Dutch-Bangla Bank. Rocket allows users to transfer money, pay bills, and recharge their mobile phones. It is widely used for both peer-to-peer transactions and commercial payments, and is favored for its reliability and speed. Rocket has also developed partnerships with numerous merchants to facilitate seamless online payments.

1.3 Nagad

Nagad is a relatively new entrant in the mobile financial service sector, introduced by the Bangladesh Postal Department. It has quickly gained traction due to its unique features and low transfer fees. Nagad aims to provide more efficient financial services to the unbanked population in Bangladesh, catering especially to the rural demographic. Users can enjoy instant money transfers and various online payment options.

2. Bank Transfers

Traditional bank transfers remain a solid option for online transactions. Most banks in Bangladesh offer internet banking and mobile banking services that allow users to transfer funds directly from their bank accounts to merchant accounts. This method is particularly secure but can be slower compared to mobile wallets.

2.1 Internet Banking

Internet banking allows users to manage their bank accounts online, including transferring money, paying bills, and checking their balance. Banks like BRAC Bank, Standard Chartered, and City Bank offer comprehensive internet banking services. While it may require a bit more setup than mobile wallets, it is a preferred option for those who prioritize security.

2.2 Mobile Banking

Similar to internet banking, mobile banking services provided by banks let customers conduct financial transactions through their smartphones. This includes fund transfers, bill payments, and even mobile recharges. Many users find mobile banking to be convenient due to its accessibility and ease of use.

3. Credit and Debit Cards

Credit and debit cards are widely accepted for online transactions, especially for international purchases. Visa and Mastercard are the dominant players in the market, allowing users to shop online with ease. Most local ecommerce platforms accept these cards, making it an ideal option for consumers who prefer traditional banking methods.

3.1 Advantages of Using Cards

Using credit and debit cards for online payments comes with several advantages. Transactions are usually secured with encryption technologies, minimizing the risk of fraud. Additionally, users can enjoy cashback rewards or loyalty points from their banks, making it a financially beneficial choice in the long run.

3.2 Challenges Faced

Despite their advantages, card payments can be challenging for some users. Issues such as insufficient funds, expired cards, or international transaction restrictions can complicate the payment process. Furthermore, not all local vendors are equipped to accept card payments, particularly in rural areas.

4. Digital Wallets and Cryptocurrency

Digital wallets and cryptocurrencies are emerging trends in the Bangladeshi payment landscape. While still in the early stages of adoption, platforms like PayPal and cryptocurrencies like Bitcoin are gradually gaining acceptance among tech-savvy users. Digital wallets allow users to store and manage their payment information securely, while cryptocurrencies offer an alternative method for online transactions.

4.1 The Rise of Cryptocurrency

Cryptocurrency usage has been gaining attention globally, and Bangladesh is no exception. However, the regulatory landscape for cryptocurrencies is still uncertain. Users interested in cryptocurrencies must remain informed about legal implications and market fluctuations before diving into this realm.

4.2 Advantages of Digital Wallets

Digital wallets simplify transactions, allowing users to store multiple payment methods in one place. They may offer other features like transaction tracking or budgeting tools, providing additional value to users. The convenience of digital wallets can significantly enhance the online shopping experience.

Conclusion

Bangladesh’s payment landscape is evolving rapidly, offering people various options for online transactions. From mobile wallets like bKash and Rocket to traditional banking methods and innovative digital wallets, there are solutions catering to diverse needs. As technology continues to change how people transact, it will be crucial for users to stay informed about different methods available to ensure secure and efficient online payments. Ultimately, as ecommerce grows, the diversity of payment options will foster a more inclusive financial ecosystem, benefiting everyone from consumers to merchants.

Leave A Comment